Find Out Which Pet Insurance Is Right For You

How to decide what pet insurance company and plan is right for you!

When it comes to pet insurance, many pet owners aren’t sure if they really need it.

Pet insurance helps pet owners pay the cost of medical expenses if the pet becomes ill or has an accident. Some pet insurance plans cover routine checkups and wellness procedures, such as annual exams, spaying, neutering, etc. Veterinary bills can be very high and pet insurance can help to offset the cost. However, in some cases pet insurance can cost more than it pays out so it’s important to consider your own unique situation and various factors before deciding whether or not to purchase pet insurance.

What features matter most?

What’s covered?

The most important thing to understand about pet insurance is what is covered and what is not. Some policy holders think that pet insurance automatically covers all medical expenses but every policy has different limits and exclusions.

- Read the plan: Before purchasing pet insurance, read the plan carefully so you have an understanding of what illnesses, medical visits, medication, etc. are covered and what are not. For example, surgery could be covered, but spaying/neutering might not. Emergency visits because of an accidental injury may be covered, but routine wellness visits may not. And in many cases, cosmetic procedures, boarding and grooming, and supplements will not be covered.

- Limits and deductibles: All insurance policies stipulate limits of their coverage. Typically, pet insurance will have limits per accident or illness, as well as a limit for the policy term. Out-of-pocket deductibles can be based on both a per-inside and per-policy term basis. Find out what the limits of coverage are, and if they could cover a reasonable portion of expensive procedures.

- Extra costs: Pets with existing conditions or advanced age may be refused coverage or might require higher premiums to cover their medical insurance. Be sure to read carefully to determine if your pet will incur any extra costs.

Can coverage be denied?

If you have pet insurance, you might assume that it will cover all medical issues and expenses, but many times coverage can be denied.

- Negligence: Some insurance policies won’t cover expenses if it has been deemed that the owner was at fault.

- Accidental: Accidents happen, but if you haven’t purchased comprehensive coverage or another form of accident insurance, you might end up paying out of pocket.

- Age range: Most pet insurance policies have a low end and a high end to sign up for a new policy. Make sure the plan covers the current age of your pet.

Healthcare providers

Insurance companies may work with and cover different medical providers, which takes the pressure off you to find one. The disadvantage of this is that some medical providers won’t be as good as the ones you might want to visit and you won’t be reimbursed for using vets that the policy doesn’t cover.

- Do the service providers have good reviews?: Check out the fine print to find out if service providers are prescribed by the insurance network, and if so, do a little investigative research to find out how reputable they are.

- Can you use providers out of network?: Such policies may cover both in and out-of-network providers, but the latter can sometimes cost more. Find out which vets your policy allows and if the coverage is the same for out-of-network vets.

Cost

The cost of pet insurance varies according to your location, what type of pet you have, your pet’s age and what type of coverage you choose. Similar to human health insurance, pet insurance also has premiums, deductibles, co-pays and maximum payouts.

- Premium: The premium is the amount you pay monthly, quarterly or annually for your insurance policy.

- Deductible: The deductible is the amount of the vet bills you have to reach before the insurance company starts to pay. Higher deductibles usually mean a lower premium, but more of your money is invested over the initial medical expenses.

- Co-pay: Most insurance policies will cover only a portion of medical expenses even after you’ve met your deductible and expect you to cover a portion. For example, your policy might stipulate that you pay 20 percent and the insurance company pays 80 percent. Higher co-pays will lower your premium as well but will increase your out-of-pocket payments for each expense. When determining reimbursement, also keep in mind that some pet insurance policies pay out as a percentage of the invoice while others pay out on certain amounts for certain conditions or operations, no matter what the bill was.

- Maximum payout: Most insurance policies will determine a maximum amount of money they will give you, whether it is a certain amount each year, per event or during the lifetime of your policy. Once it is reached, you will not receive any more money.

Health expenses

In deciding whether or not to purchase insurance, try to estimate what your average veterinary health expenses are and will be in the future.

- Current pet health: How old are your pets? Are they in fairly good shape, or do they require medication or have a chronic illness?

- Environment: Do you live in a safe, quiet environment, or is the pet exposed to things like other pets, cars on the road, ticks, etc. — anything that could cause accidents or health problems requiring medical attention?

- Breed: Certain breeds or animals are at higher risk for health issues than others (and some may even be excluded from certain insurance policies).

Insurance company reputation

Pet insurance providers should have a good reputation for helpful customer service, reliable coverage and good value.

- Coverage options: Insurance companies should offer different plans and extensive coverage options for different conditions.

- Reviews and complaints: Find out as much as possible about what kind of experience other customers have had with the insurance company and be aware of any complaints people have made about them.

- Filing a claim: Find out what the process is to file a claim. Is it simple and hassle-free, or will you be on the phone with customer service for hours at a time? Does the insurance company typically fight claims or do they reimburse expenses? If so, how long does it typically take for the company to reimburse you? Some insurance plans will pay the vet directly, so that you don’t have to pay out of pocket initially.

What are different types of pet insurance coverage?

Basic coverage

This traditional form of pet insurance coverage mirrors your typical human health insurance plan. It generally covers anything accidental, such as unforeseen injuries or illnesses—even poisonings. Basic coverages typically include deductibles and caps on total payouts per policy term.

Wellness plans

Want coverage to help finance for routine care? Then a pet wellness plan is for you, to help pay for annual exams, teeth cleanings, vaccinations and other similar preventative treatments.

Comprehensive coverage

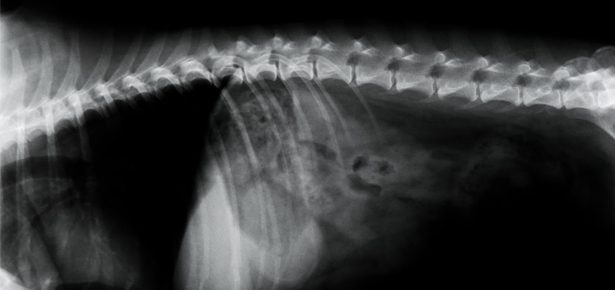

While covering most everything that a traditional basic plan would cover, comprehensive takes pet insurance one step further by including preventive care (such as vet visits, X-rays and vaccinations) and prescription medicines.

Vet packages and network plans

Additional pet insurance-like pet products are often sponsored by veterinarians themselves or in conjunction with pet stores. For instance, certain vets will offer their customers essentially what are package deals, which provide discounts on care and checkups. Or vets and pet stores may team up to offer plans that give discounts on surgeries and care, as well as on pet food and other supplies.

Other coverage

For pets that are exotic or worth a lot to their owners, life and theft insurance can be bought as a separate plan. Pet owners can also consider liability coverage to protect them should their pet bite or harm another person. Typically, homeowners or renter’s insurance provides enough protection, but for certain more aggressive breeds, additional insurance may be needed.

Who’s it for?

First-time pet owners

People getting pets for the first time will want the security of pet insurance, especially if the pet is young, like a puppy. Puppies are more likely to get sick and having pet insurance can help a new owner get through a stressful time without having to also worry too much about expenses.

Pet owners with older pets

Owners with aging pets need insurance to cover any diseases that may arise and to continue any treatments for existing conditions.

Owners with multiple pets

People with more than one pet can potentially save a lot of money with pet insurance. Paying for services individually is sure to add up over time, and having insurance will keep out-of-pocket expenses low.

Owners of young pets

Owners with young pets will find that trips to the vet during the first year is routine. From vaccinations to checkups, pet health insurance can help offset the cost of those visits. Insuring younger pets is usually more cost-effective and can save the owner money over the pet’s lifetime.

Via Consumer Affairs. For reviews and to take the Pet Insurance quiz click here.

{Sponsored}

Pet health insurance is the smart way to make sure your pet always gets the best care—without worrying about the cost. A pet insurance plan lets you give your furriest family members the best health care possible by reimbursing you for eligible veterinary costs. Visit any licensed veterinarian in the United States or anywhere else in the world. Submit claims quickly and easily submit claims online for things like illnesses, injuries, or emergency care. Receive reimbursements for eligible vet costs covered under your policy terms. Customize your policy to find the best coverage for your budget. Be prepared for the unexpected and get your pet covered today. petinsurance.com

Join the newsletter and never miss out on dog content again!

"*" indicates required fields

By clicking the arrow, you agree to our web Terms of Use and Privacy & Cookie Policy. Easy unsubscribe links are provided in every email.